Everything You Need to Know About the Deposit When Buying Property in Kenya or When Hiring an Advocate.

FEBRUARY 06, 2025 Update: In a country where fraudsters are becoming increasingly clever, how can you protect yourself from those who pressure you to pay a deposit as a sign of genuine interest in a property you wish to buy? Additionally, how can you identify and avoid incompetent advocates who ask for deposit payments before providing any services? When should you….

PUBLISHED: FEBRUARY 05, 2025 UPDATED: FEBRUARY 05, 2025.

18 MINUTES READ TIME

WRITTEN BY:

Joshua Munuve, Digital Marketing Associate at Musyimi Damaris & Company Advocates.

REVIEWED, FACT-CHECKED & APPROVED BY:

Damaris Musyimi, Founder and Head Advocate at Musyimi Damaris & Company Advocates.

The Ultimate Guide Paying The Deposit When Buying Property in Kenya or Hiring a Lawyer.

Paying a deposit is essential for securing your interest in most transactions in Kenya, whether you are buying property, acquiring a developed real estate property, hiring a lawyer, or when resolving a legal matter through Alternative Dispute Resolution. At Musyimi Damaris and Company Advocates, we have extensive experience assisting clients in purchasing property in Kenya. The timing and conditions for paying a deposit vary depending on the specific context of the property transaction or legal matter.

In this straightforward blog, we will explain everything you need to know about paying a deposit in various property transactions in Kenya. Additionally, we will outline practical steps to protect yourself from potential fraud when making a deposit.

Table of Contents:

Paying Deposit When Buying Land in Kenya.

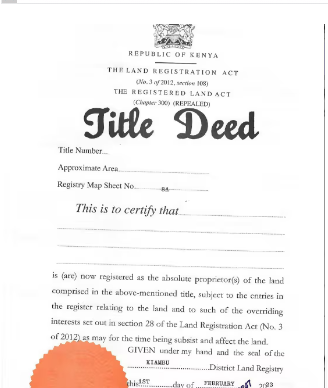

You find yourself in a situation where you’re interested in purchasing land in Kenya. You’ve identified a piece of land that perfectly matches your desire. The seller informs you that you need to pay a down payment (deposit) of at least 10% of the purchase price to initiate transferring the title deed into your name. You would then pay the remaining amount in installments as agreed between you and the seller. Alternatively, the seller might say that the land is in high demand and that the deposit will demonstrate your seriousness and commitment to buying the land.

On one hand, you may feel suspicious and worry that you could be conned, as you don’t know much about the seller. On the other hand, you may fear losing the opportunity to own this land if you don’t pay the deposit upfront.

When purchasing land in Kenya, paying a deposit is essential as it shows sincerity and commitment to the seller. The best and ideal practice is to pay the deposit only after two critical steps have been completed:

- Your property lawyer must be satisfied with the findings from the due diligence process.

- Both you, the buyer, and the seller need to sign the sale agreement in the presence of your property lawyer.

The due diligence process is vital because it ensures that:

– The land has no disputed title.

– No cautions are preventing the land sale.

– The land is not encumbered by any mortgages or loans.

– The land is legally permitted for your intended use.

– The land is not involved in any ongoing court proceedings, which could make the purchase illegal.

– The land does not belong to a deceased person, and the seller is legitimate.

We strongly advocate for paying the deposit only after you and your property lawyer are confident in the due diligence findings.

Signing the sale agreement is also important because doing so in the presence of your property lawyer makes it legally binding. This means that if either you or the seller breaches any of the terms, the affected party can take legal action for breach of contract.

In addition, the property lawyer representing the seller must include a clause in the sale agreement that specifies the deposit amount. The agreement should also outline the balance, payment method, and payment period. Both parties and their lawyers should sign it as witnesses.

This approach is shaped by our extensive experience in assisting clients with land purchases in Kenya, as well as our awareness of the numerous cases of land fraud.

However, we have observed that the approach mentioned above tends to work best in situations where land is not subject to competitive bidding. When purchasing land in Kenya’s competitive market, it is crucial to understand that many sellers—especially those offering prime properties—often receive multiple offers. Consequently, sellers usually require interested buyers to pay a deposit immediately to demonstrate their commitment to the purchase.

In such cases, we recommend that you pay the deposit, but not directly into the seller’s account, as your property lawyer may not have conducted due diligence yet. Instead, consider one of the following payment methods:

(i) Pay the deposit through your property lawyer to the seller’s account.

(ii) Pay the deposit to the seller’s property lawyer’s account, if one exists.

(iii) Pay the deposit into a trust account managed by either your property lawyer or the seller’s property lawyer, if applicable.

The first option is straightforward: by allowing your property lawyer to act on your behalf in the transaction, all requests from the buyer are directed through them. Your trusted property lawyer has a responsibility to protect your interests, as their reputation is also at stake.

The reasoning behind the second option is that both you and the seller have engaged property lawyers to represent you throughout the transaction. This means that both lawyers are legally obligated to ensure that everything is processed correctly. If the seller’s property lawyer fails to meet their obligations, your lawyer can intervene on your behalf until the deposit is returned. Therefore, it’s crucial to choose a property lawyer whom you can trust.

The last option highlights that your deposit is kept in a trust account, which secures your funds until specific conditions are met. This means the seller cannot access the money, giving you and your property lawyer sufficient time to perform due diligence. This setup protects you from potential fraudsters who may pose as land sellers and pressure multiple buyers into paying deposits. Additionally, if the Land Control Board does not approve the sale of a piece of land, having your deposit in a trust account ensures that you will receive your money back. For these reasons, we strongly recommend having a reliable property lawyer to guide you when making a deposit; they are best equipped to advise you based on your unique situation.

The Amount Payable As Deposit.

When purchasing land in Kenya, the deposit amount can vary based on the sale agreement, but it typically ranges from 10% to 30% of the agreed purchase price. Once both parties have agreed to the terms of the sale agreement, it should be signed by the parties or any of their legally appointed representatives in the presence of their property lawyers. The sale agreement must also include the deposit cheque or proof of deposit payment.

However, we have observed that disagreements sometimes arise between buyers and sellers regarding the deposit amount. For example, there is an increasing trend of land sellers demanding either more than half of the sale price or full payment upfront. There is no one-size-fits-all solution to this issue, as the circumstances can vary significantly in each situation. Therefore, we strongly recommend having a property lawyer assist you throughout the process.

For clarity, property lawyers often outline the payment method and timeline in the sale agreement.

What Paying the Deposit Means for the Land Buyer.

Paying a deposit simply secures your interest in the land as a buyer. However, from our experience, some land buyers mistakenly believe that paying the deposit guarantees their ownership of the land. This is rarely the case, as failing to complete the payment within the stipulated time can be legally risky. For example, some sale agreements include a forfeiture clause, which requires the buyer to forfeit all payments made in the event of default.

If a buyer fails to make payments as agreed, it constitutes a breach of contract. This gives the seller legal grounds to sue the buyer since courts uphold the written contracts signed by both parties when resolving property disputes. To avoid this issue, we advise our clients to first ensure their finances are in order before beginning the process of buying land in Kenya.

Tips for Protecting Yourself When Paying the Deposit for Buying Land in Kenya.

Based on our experience, we recommend the following:

- Deposit Payment: Only pay the deposit after you and the seller have signed a Sale Agreement in the presence of a qualified property lawyer. It is advisable to pay the full purchase price only after the land has been officially transferred into your name and the land registry has issued the title deed.

- Conditions Precedent for Deposit Payment: Before paying the deposit, complete your due diligence. This includes verifying the land’s title deed, ensuring that the seller has the legal right to sell, and confirming that there are no legal encumbrances on the property. A clear title is essential; there should be no outstanding claims or disputes regarding the property. Make sure to wait until you are confident that the transaction is legally sound before making any deposit.

- Engage an Experienced Property Lawyer: It is crucial to contact a reputable property lawyer in Kenya whenever you intend to buy land in Kenya. Your property lawyer will search the land for sale and review the title deed to protect you from future legal issues concerning land ownership. We like to compare a property lawyer as more of an insurance policy than an expense.

- Buying Land with a Mother Title:

The ideal situation is for the landowner to subdivide the property before selling it to you. Do not pay 100% of the purchase price to the owner and then wait for the title deed.

Before paying the 10% deposit, conduct thorough research and check with neighbors and family. Your trusted property lawyer will assist with the search, draft the Sale Agreement, follow up with the owner and the surveyor tasked with the subdivision, and provide general legal advice. If experienced, they may even use this situation as a negotiation tool in your favor.

In summary, paying 100% of the purchase price before the subdivision has been completed and the title deed for the land you are buying has been issued may eliminate your leverage over the owner regarding the subdivision and obtaining the title deed. Furthermore, without proof of ownership, you could encounter issues if another person claims ownership of the plot or the entire parcel of land after you have made your payment since an agreement signed before the area chief will not hold much legal weight.

If you are considering purchasing land that the owner claims does not have a title deed but instead has a mother title (which needs to be subdivided), and the owner suggests that you write an agreement at the area chief’s office while waiting for the title deed, we strongly advise engaging a property lawyer immediately. While some of these situations may be genuine, others could be scams, and a lawyer can help you discern the difference.

Paying Deposit for a Real Estate Property Transaction.

The primary distinction between purchasing land and engaging in a real estate transaction is that a real estate transaction involves land that has already been developed. Similar to buying land, your deposit in a real estate transaction is primarily protected by the clauses outlined in the sale agreement. These clauses specify what happens to the deposit if the transaction does not go through. For instance, if the property seller breaches the agreement, you may be entitled to a refund of the deposit. Conversely, if the buyer defaults, the seller may retain the deposit as liquidated damages.

In some cases, the deposit may be paid conditionally in installments, meaning part of the deposit is paid after securing financing or once the title deed is transferred.

To avoid scams when buying property, it is highly recommended to utilize a trust account. You should pay the deposit into a trust account managed by your real estate lawyer or a trusted intermediary, rather than directly to the seller. This helps ensure that the transaction is legitimate and secure.

Aditionally, it is crucial never to pay any deposit before signing a formal sale agreement, as doing so can expose you to fraud or other risks. Your property lawyer can assist you in negotiating favorable deposit terms, identifying any red flags in real estate transactions based on their expertise, and taking precautionary measures to protect you.

The same tips for protecting yourself when buying land in Kenya also apply to real estate transactions.

Paying for Deposit in a Commercial Land Dispute.

In the case of commercial land disputes involving business transactions or contracts, the timing of a deposit may depend on whether the dispute involves a contractual agreement or the solution of the dispute itself. Here are the key scenarios in which deposits may be involved. In commercial land dispute contracts, the timing of the deposit is during the signing of the contract. These commercial land dispute contracts could be ones around leasing, supply agreements, and joint ventures like renting. The deposit secures the terms of the agreement and assures the other party that the contract will be executed.

The other scenario is the payment upon agreement and the deposit is paid after both parties sign the contract but before the full execution of the terms like occupying a leased property or delivering goods. The deposit may also serve as security to protect one party if the other defaults on the contract.

The amount of deposit will vary depending on the type of contract, it is however a percentage of the contract value(often 10% to 30%) and is agreed upon in advance. Having a property lawyer with experience in commercial land disputes helps shield you from being misled and possibly defrauding.

Paying for Deposit in Alternative Dispute Resolution(ADR).

In our experience, Alternative Dispute Resolution (ADR) and Alternative Justice System (AJS) play a crucial role when it comes to addressing commercial disputes, particularly in Kenya, where arbitration and mediation are commonly employed methods for resolving business-related conflicts. When parties decide to pursue these avenues, a deposit is often required to initiate the process. This deposit is essential as it helps cover the various costs associated with the arbitration or mediation proceedings.

Typically, this ADR/AJS deposit needs to be paid either before the process begins or at its outset. The exact amount of the deposit is usually determined by the institution responsible for conducting the arbitration or mediation, such as the Chartered Institute of Arbitrators – Kenya Branch. The specific fee can be established through mutual agreement among the parties themselves.

The role of a property lawyer in the context of Alternative Dispute Resolution is multifaceted. Initially, they are responsible for advising you on whether your particular commercial land dispute is suitable for resolution through ADR methods. Additionally, they play a vital role in representing your interests during negotiations, ensuring that your rights and concerns are effectively addressed throughout the resolution process.

Paying Deposit as Retainer Fees to an Advocate for Legal Representation.

- Payment to Property Lawyers: When dealing with land disputes, especially those that are intricate or complicated, it is common for land advocates to require a retainer fee. This upfront payment serves to secure their services and cover the preliminary costs associated with your case. Typically, the terms of the retainer fee are discussed and agreed upon before the lawyer commences their work, ensuring they receive compensation for their efforts throughout the commercial land dispute.

- Timing: The retainer fee is paid before the property lawyer initiates any work on the case. This fee is intended to cover a variety of essential services, including initial consultations, thorough research, the collection of evidence, attendance at court hearings, and the meticulous preparation of supporting legal documents.

Summary of Key Timing Points When Paying Deposit

Scenario | When to Pay the Deposit |

Land Buying Transaction. | After signing the sale agreement, once due diligence is completed. |

Commercial Contracts | After signing the contract but before full execution. |

Alternative Dispute Resolution (ADR) | At the initiation of the arbitration or mediation process. |

Litigation (Court Case) | At the time of filing the case or when ordered by the court (e.g., security for costs). |

Legal Retainers for Land Disputes | Before the advocate begins work on your case. |

By ensuring you follow the tips explained, including the timing and payment guidelines, you can protect yourself and ensure that your deposit is properly handled in both property transactions and property disputes of any nature.

To read more of our informative blogs, including the process of foreigners to buy and own homes and land in Kenya, click here. If you have any questions regarding buying land in Kenya, check out our Frequently Asked Questions. You can also send us a confidential message through our contact us form or directly call us at 0795470796 for an affordable legal review of your matter.

Paying Deposit Supporting Sources

- Kenya Revenue Authority.

- Kenya Law Organization.

- Ardhisasa.

- Ministry of Lands and Physical Planning.

- Eregulations Kenya.

- Real Estate Law Society of Kenya (RELSK)

- Survey of Kenya offices.

- The Law Society of Kenya.

- National Legal Aid Service.

- State Department for Lands and Physical Planning.

- The Land Control Board.

- National Environment Management Authority. (NEMA)

- SheriaHub.

- Google Earth.

- eRegulations Kenya.

- Office of the State Law.

WRITTEN BY:

Joshua Munuve is a Digital Marketing Associate at Musyimi Damaris & Company Advocates. He has driven the growth of the law firm's online presence from getting no clients online to getting multiple and consistent clients a month to the point of online inquiries and consequent clients being more than walk-in inquiries and consequent clients. This has been achieved through his web development skills.

REVIEWED, FACT-CHECKED & APPROVED BY:

Damaris Musyimi is the Founder and Head Advocate at Musyimi Damaris & Company Advocates. With over three years of experience in legal practice, she has assisted numerous Kenyans in recovering more than 100 hectares of land. Additionally, she has guided many individuals in purchasing property and has supported families with succession and inheritance matters. Several legal organizations she previously collaborated with continue to consult her on various legal issues.