Buying Land in Kenya: A Beginner’s Jargon-Free Guide to the Legal Process of Buying Property in Kenya.

January 30, 2025 Update- As you research buying land in Kenya, you’re likely concerned about land fraud, especially in a country where fraudsters are becoming increasingly smart. You may know people who have fallen victim to scams when buying land in Kenya. Additionally, land laws are being amended regularly at both the national and county levels, leaving you wondering how to keep up with the changes. Furthermore, land prices are continually rising. To make matters worse, some property lawyers are incompetent, making it difficult to find reliable legal assistance as you navigate the process of buying land in Kenya. So which is the safest process you can…..

PUBLISHED: JANUARY 23, 2025 UPDATED: JANUARY 30, 2025.

48 MINUTES READ TIME

WRITTEN BY:

Joshua Munuve, Digital Marketing Associate at Musyimi Damaris & Company Advocates.

REVIEWED, FACT-CHECKED & APPROVED BY:

Damaris Musyimi, Founder and Head Advocate at Musyimi Damaris & Company Advocates.

Everything You Need to Know About the Process of Buying Land in Kenya to Be Safe From Land Fraud. (Proven)

If you’re a Kenyan interested in buying land in Kenya, there could be various reasons driving your decision. Some Kenyans are influenced by those around them who are investing in property and real estate. Others may have encountered advertisements on social media or have savings they want to invest for passive income. For some, buying land in Kenya is a way to diversify their investment portfolio after already investing in stocks, cryptocurrencies, bonds, and other assets.

Additionally, many Kenyans have observed their parents and relatives buying land in Kenya, which subconsciously shapes their land-buying ambitions. Some choose to buy now to avoid rising land prices in the future. Others see land acquisition as a part of their retirement plan, envisioning a peaceful life with their loved ones in their later years.

Regardless of your reasons, there is a legal process to follow to turn your dream of buying land in Kenya into reality. In this blog, we aim to remove the legal jargon around the steps involved in buying land in Kenya. We will outline the practical measures that have proven effective over the years while helping Kenyans buy and sell land in Kenya at Musyimi Damaris & Company Advocates.These steps not only streamline the process but also ensure safety for you, the land buyer.

Table of Contents:

- Understanding The Types of Land Ownership in Kenya.

- Lands That Can Be Bought in Kenya and Land Zoning Regulations.

- The Legal Process of Buying Land in Kenya.

Understanding The Types of Land Ownership in Kenya.

When buying land in Kenya, it’s essential to recognize that both historical and traditional factors influence the country’s land ownership structure. As a result, the current system includes a combination of customary and formal laws regarding land ownership. There are two main types of land ownership in Kenya, which are explained below:

1. Freehold Land Ownership: This type grants the title deed holder complete ownership of the land, allowing them to utilize it for any purpose, as long as they comply with local regulations and planning laws. Freehold ownership is typically found in rural areas.

2. Leasehold Land Ownership: This type provides the right to use the land for a specified duration, usually up to 99 years, after which the lease can be renewed. Leasehold ownership is more common in urban areas and is often held by the government or local authorities.

Lands That You Can Buy in Kenya and Land Zoning Regulations.

If you’re buying land in Kenya, it’s important to understand the different types of land available and the regulations that govern them. Based on our experience and the law, there are four main types of land in Kenya:

Community Land: This type of land is owned by communities, such as clans, tribes, or villages.

Public Land: This land is owned by the government and is designated for public purposes, including roads, schools, and public hospitals.

Trust Land: This is land that the government holds in trust on behalf of communities that do not have title to the land.

Private Land: This land is owned by individuals or corporations.

Understanding these categories is crucial for navigating the land-buying process in Kenya.

Land Zoning Regulations.

As you look to buy land in Kenya, it’s important to understand the zoning classifications that apply. Land in Kenya is designated for various uses, including:

- Residential.

- Commercial.

- Agricultural.

- Industrial.

Familiarizing yourself with the zoning regulations in the area where you wish to buy land is essential. These regulations will determine whether the land is suitable for your intended use and if you require any special permits or approvals.

The Legal Process of Buying Land in Kenya.

Buying land in Kenya involves several steps to ensure that the transaction is legal, secure, and well-documented. While the process can be relatively straightforward for residential properties, it may require more thorough due diligence for commercial or high-value land transactions, particularly in areas with land disputes or public land issues. Therefore, having an experienced property lawyer in Kenya representing you serves as a valuable investment rather than an expense. Here are the steps to follow when buying land in Kenya.

1. Preliminary Steps: Budgeting, Conducting Research, & Due Diligence On Buying Land in Kenya.

I. Budgeting for Your the Land You Want to Buy in Kenya

Before you begin your search for land to buy in Kenya, it’s crucial to establish your budget. Be sure to take into account all associated costs, including the purchase price, legal fees, survey fees, and any additional charges for land development.

When considering financing options, you might explore sources such as your savings, bank loans, mortgages, or funds from Saccos and cooperatives. Proper budgeting ensures that your dream of owning a piece of land in Kenya is not delayed or hindered by a lack of financial resources.

II. Research & Identify the Land You Want to Buy in Kenya

After getting the budget in order, the next step in buying land in Kenya is to identify the type of property you want. This decision should be based on your personal preferences such as location, weather, and the land zoning regulations previously discussed.

During this stage, we advise clients not to feel pressured to commit to any agreements yet. It’s important to visit the site and ensure that the land meets your preferences before moving forward.

You can explore property listings through various channels, such as online platforms, real estate agents, property expos, or directly from individual sellers. Remember, this is a pressure-free phase—take your time to explore your options before making any serious commitments.

III. Conduct Thorough Due Diligence

Based on our experience, this is the most important phase of buying land in Kenya. This is because if some factors don’t tick, we immediately advise our clients to consider buying other pieces of property elsewhere. It is essential to conduct thorough due diligence. This ensures that you are buying from a legitimate owner, that the land is legally available for sale, and that it is free from disputes or encumbrances. When we conduct due diligence for our clients, we have observed that thorough due diligence must address the following:

For the land seller:

- Determine whether you are buying land from a Kenyan citizen or a foreign national.

- Ensure that the land seller possesses all necessary identity documents required to sell land in Kenya.

- Verify that the Registrar of Persons recognizes the land seller as a citizen.

- Confirm that the land seller is not involved in any legal disputes about the land they wish to sell.

- Establish that the land seller is acknowledged as the legitimate owner by the relevant Lands Registry.

For the land:

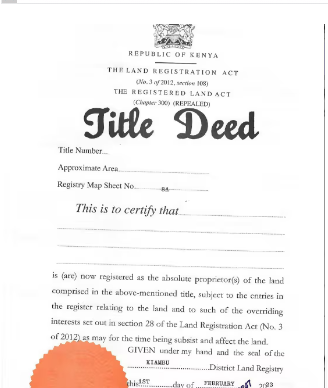

- Ensure that the title deed is recognized by the Lands Registry.

- Confirm that there are no cautions or restrictions preventing the sale of the land. This will ensure you do not violate any laws by buying that property.

- Verify that the plot number on the title deed matches the record in the Lands Registry.

- Check that there are no pending court cases involving the land.

- Ensure there are no encumbrances, such as mortgages, on the land. Buying such land in Kenya may require additional payment to obtain the title deed.

- Compare the land measurements on the title deed with the actual dimensions of the land. This may require a physical visit to the site.

- Check for any unaccounted transactions on the land’s green card, which contains a complete history of all transactions related to the property.

- Confirm that the land is not part of a large-scale settlement scheme, as such properties may be subject to legal disputes and complications with final registration. It is generally advisable to avoid purchasing these.

- Verify that there are no unpaid rates or taxes associated with the property.

- Ensure that the size of the land matches what is indicated on the title deed.

- Confirm that the land is not involved in an ongoing estate distribution of a deceased person’s assets. Purchasing such land may be illegal and could expose you to unnecessary lawsuits.

For the property lawyer:

- Ensure that the property lawyer is licensed by The Law Society of Kenya to practice law in Kenya. This protects you from fraudulent property lawyers who may be involved in large land fraud schemes, and it also ensures accountability.

- Check if the lawyer has experience with similar transactions. This helps you avoid property lawyers with a questionable track record in property dealings.

For the real estate agent:

- The real estate agent must have a valid practicing number.

- The real estate agent should be licensed by the Real Estate Association of Kenya.

- The real estate agent should have a solid track record.

Many people tend to stop the process after receiving satisfactory search results. However, we recommend further verification to check if the land is mentioned in the report by the Commission of Inquiry on Illegal and Irregularly Allocated Land, commonly referred to as the Ndung’u Land Report. If the property is listed in this report, we strongly advise considering an alternative land purchase.

This recommendation is based on the ongoing issues of land fraud in Kenya. At Musyimi Damaris & Company Advocates, we are committed to conducting thorough due diligence to protect our clients. If you’d like our help with due diligence, call our office for an affordable, no-obligation legal review of your land-buying venture.

IV. Confirming Land Use Zoning

Based on the findings of due diligence, it’s important to consult with the relevant local authorities, such as the county government or Nairobi City County, to verify that the property falls within the appropriate zoning classification for your planned use- be it residential, commercial, agricultural, or any other category. This step will help ensure compliance with local regulations and that your intended activities are permitted on the property.

V. Addressing Any Boundary Disputes

If the findings of your due diligence reveal there might be any disputes or uncertainties regarding property boundaries, your trusted property lawyer will advise you to engage the services of a professional surveyor. An experienced property lawyer in Kenya has contacts of reliable surveyors whom they can connect you to. The surveyor provides a precise assessment and confirms the exact boundaries of your property. Additionally, you can consult with a government surveyor who can offer valuable information and verification regarding landlines and any related issues.

2. Agreement to Sell (Siging the Sale Agreement)

I. Drafting the Sale Agreement.

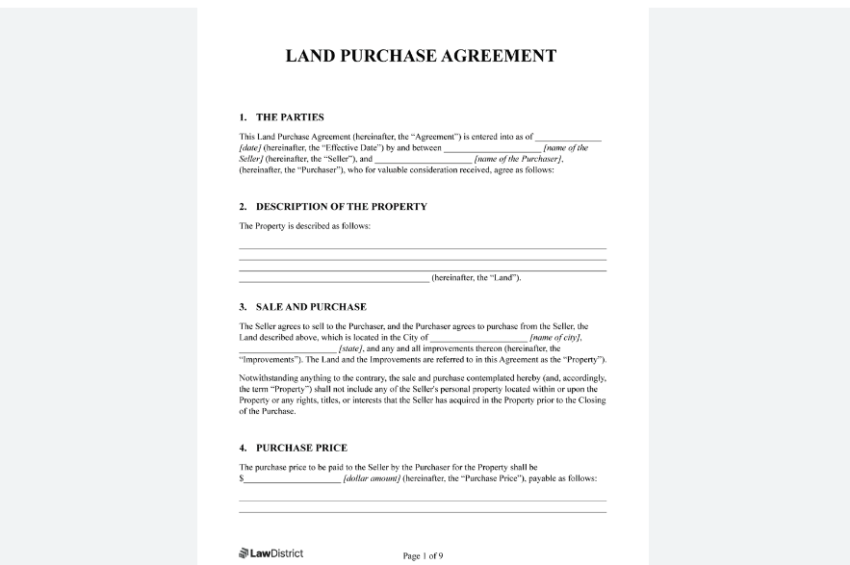

This part of buying land in Kenya comes after completing the due diligence and it involves entering into a Sale Agreement with the seller. This legally binding document details the terms of the property transaction, as shown in the table below:

Land Sale Agreement Details. | Description. |

| The document includes their official names, identification numbers, and other relevant details. |

| This document contains information about the location, boundaries, size, title deed number, and other relevant details. |

| The agreed-upon price for the land. |

| Payment conditions for the remaining balance which could be installments or full payment upon completion. |

| The deposit amount typically ranges from 10% to 30% of the total price. |

| The deadline for finalizing the property transfer. |

| Any requirements that must be fulfilled for the sale to proceed (e.g., settling any outstanding debts or taxes, obtaining necessary approvals). |

| This section outlines the consequences if either party breaches the contract. |

| Both parties must sign the agreement in front of witnesses, property lawyers, or independent witnesses. |

We highly recommend that you have a property lawyer in Kenya to review or draft the sale agreement. The property lawyer will ensure that the document complies with Kenyan law and properly protects your interests. Additionally, we have found that reviewing the agreement clause by clause helps clients better understand what they are entering into and allows them to prepare accordingly.

II. Signing the Land Sale Agreement & Payment of the Deposit

In this phase of buying land in Kenya, both the buyer and seller must sign a sale agreement. After signing, the buyer usually pays the agreed-upon deposit to the seller. However, we recommend that you pay the deposit into a trust account held by the buyer’s lawyer for added protection.

3. Payment of Balance and Transfer of Land Ownership

I. Payment of the Land Price Balance

In this phase of buying land in Kenya, the sale agreement is signed, and the deposit is already paid. The buyer will then make the remaining payment (the balance) according to the agreed-upon payment terms. This could be paid as a lump sum or in installments. Typical payment methods include bank transfers, checks, or other secure methods. We strongly advise land buyers to obtain receipts for all payments made throughout the land-buying process.

II. Preparing the Land Transfer Documents

During this phase of buying land in Kenya, the buyer’s property lawyer will start preparing the transfer documents and make sure that all taxes and fees, such as stamp duty, are paid. The seller is typically responsible for settling any outstanding rates and taxes on the property before the transfer takes place.

4. Payment of Stamp Duty and Registration

I. Payment of Stamp Duty

When buying land in Kenya, stamp duty is a tax imposed by the government on property transactions. The amount of stamp duty payable varies based on the type of property and its location, whether urban or rural.

The stamp duty must be paid to the Ministry of Lands and Physical Planning, and it is the buyer’s responsibility to ensure that this payment is made before the transfer of ownership can proceed. Payments are typically made through the Ardhisasa payment portal.

II. Registration of the Land Transfer

Once the stamp duty is paid, the next step is to register the transfer of ownership at the Land Registry. Your property lawyer will submit the transfer documents along with the necessary paperwork, including the title deed, payment receipts, copies of identification, and the stamp duty receipt, to the appropriate Lands Registry for official registration.

After successful registration, the buyer will receive a new title deed that reflects their ownership of the property.

5. Completion of the Land Transaction

I. Transfer of Land Possession

Once the property transfer is registered, it is officially in the buyer’s name, allowing the buyer to take possession of the property. The seller will hand over the land, and the buyer will then have full control over it.

II. Finalizing the Land Sale.

This is the final step in buying land in Kenya. It involves ensuring that all obligations outlined in the sale agreement are fulfilled. This includes settling any outstanding balances, completing the necessary documentation, and transferring utilities (such as water and electricity) to your name.

6. Recommended Post-Transaction Considerations

Based on our experience, we recommend the following practices after obtaining the title deed.

I. Update Your Land Records

We recommend that you update your records with the Local Lands Registry and the National Land Commission (NLC) when necessary, particularly for large commercial properties. Additionally, it is important to verify your land ownership regularly. Doing this will help prevent future disputes regarding your land.

II. Payment of Property Taxes

It is highly recommended that property rates and land rent be paid regularly to avoid penalties. Payments are typically made to the local county government.

III. Payment of Land Rates & Utilities

If the property is located in an urban area, we recommend ensuring that all land rates and utility bills (water and electricity) are paid or transferred to your name.

Key Documents You Will Need When Buying Land in Kenya.

When buying land in Kenya, it is important to have the right documents to ensure that the process is legal and smooth and that you are protected during the land transaction. These documents serve various purposes, such as proving ownership, confirming payment, and verifying proper land registration at the Lands Registry. In summary, the essential documents include:

Land Transaction Between Individuals. | Land Transaction Involving a Company. |

1. Land title deed. |

|

2. Land sale agreement or contract of sale. | II. The letter from the management company confirms that the seller has paid all the outgoings. |

3. National identity card or passport copies. | III. The original share certificate in the management company. |

4. KRA PIN certificate. | IV. The transfer of share form duly executed by the parties. |

5. Certificate of official search/ land search. | V. Form D in respect of the share transfer duly signed by the company’s auditors; |

6. Receipt for payment of receipt on the land. | |

7. Stamp duty payment receipt. | |

8. Letter of consent for land held in trust or leasehold land. | |

9. Land clearance certificates. | |

10. Land transfer forms. | |

11. Signed affidavit or consent letter from the spouse if advised so by your property lawyer. | |

12. Land surveyor’s report if recommended by your property lawyer. | |

13. Environmental impact assessment report for development properties. | |

14. Occupancy certificate for land with a building. | |

15. Power of attorney if advised so by your property lawyer. |

Charges One May Incur When Buying Land in Kenya.

When purchasing land in Kenya, several charges are involved in the process, from the moment you identify the land to the transfer of the title to the new owner. Below is a summary of the most common expenses associated with buying land in Kenya:

- Various Administrative CostsThese include making copies of the required documents, such as IDs, and costs related to site visits.

- Due Diligence Fee and Title Deed SearchThis fee is payable to the Lands Registry and is crucial for confirming the legitimacy of the land and the seller. It helps you ensure you are purchasing land that exists.

- Property Lawyer’s FeeThis fee is generally determined based on the value of the land being purchased. Each party is responsible for their legal fees, usually calculated as a percentage of the purchase price according to the Advocates Remuneration Amendment Order, 2014. A common exception occurs when buyers are required to pay legal fees for both parties when purchasing an apartment from developers. This is based on the rationale that the seller’s lawyer typically handles the registration for all leases on behalf of the buyer. This fee also covers the drafting of the land sale agreement.

- Land Transfer/Stamp DutyThis tax is based on the property’s value, relying on the amount determined by the Government Valuer or the agreed purchase price, whichever is higher. We recommend this because it protects you from possible exploitation by the seller or broker. The rates are mostly dependent on the location and the type of property.

- Registration FeesBuyers are typically responsible for the costs associated with registering the title in their names, along with any additional fees that the seller’s advocate may advise.

- Land Rates & Land Rent Clearance CertificateDepending on the tenure of the property, land rates and rents must be paid before a clearance certificate is issued. The registered owner is responsible for ensuring that these fees are paid and for obtaining the necessary certificates unless otherwise agreed.

7. Agreed Purchase PriceThe cost of the land itself, as agreed upon by the buyer and seller, is payable to the seller.

How Long Does It Take for the Title Deed to Be Ready?

From our experience, this is a common question among Kenyans who are considering purchasing land. We have observed that several factors can influence the speed at which land ownership documents are processed after the purchase.

Several factors influence the process of land and property transactions in Kenya, including:

- The type of property or land involved in the transaction.

- Any complications or disputes related to the purchase and ownership of the land.

- The efficiency of the local Lands Registry.

- The location of the land or property being purchased.

On average, the entire process, from signing the sale agreement to receiving the new title deed, can take anywhere from 6 weeks to 90 days, depending on the specific circumstances.

An experienced property lawyer in Kenya can provide valuable advice on accelerating the processing of land ownership documents based on their expertise.

Buying Land from an Individual vs from a Developer

Based on our experience, the person or entity from whom you purchase land can significantly impact the transaction process. Buying land in Kenya from developers or individuals has its own advantages and disadvantages. Here’s what you need to know about each option.

Based on our experience, the person or entity from whom you purchase land can significantly impact the transaction process. Buying land in Kenya from developers or individuals has its own advantages and disadvantages. Here’s what you need to know about each option.

Buying Land in Kenya From a Developer

Advantages | Disadvantages |

1. Infrastructure that has been pre-planned, including roads and utility systems. | 1. The package typically has a higher price. |

2. Developers may also provide payment plans to make it easier for buyers to finance their property purchases. | 2. The package provides limited options for land use flexibility. |

3. The land buyer has less negotiating power in the transaction. |

Buying Land in Kenya from an Individual Seller:

Advantages | Disadvantages |

1. Provides greater flexibility in land use. | 1. There are various risks involved, including potential land disputes and the absence of proper documentation. |

2. The land buyer has some negotiating power regarding the terms of the purchase. | 2. It often lacks the benefit of pre-existing infrastructure, particularly if the land is undeveloped or bare. |

3. A flexible payment plan for the land can be established. | |

4. The cost of land is often lower than that sold by developers. |

Regardless of your choice, it is essential to have a trusted property lawyer to guide you through the process and assist with due diligence. If you decide to purchase from an individual, your property lawyer will verify that the seller has all the necessary paperwork before the transaction proceeds. On the other hand, if you choose to buy from a developer, your property lawyer will ensure that you are dealing with a legitimate company, confirming that they actually own the land they are selling to you.

2 Most Common Challenges Facing People Wanting to Buy Land in Kenya and How to Overcome Them.

1. Land Fraud and Scams

Land fraud is a significant problem in Kenya, with many buyers falling victim to con artists who sell land they do not own or provide fake title deeds. Statistics indicate that 7 out of 10 Kenyans are likely to be conned when purchasing land. To avoid scams, we recommend verifying the seller’s credentials and cross-checking the information with the Ministry of Lands.

You can also contact us for a FREE guide on how experienced land buyers in Kenya detect and avoid land fraud, and learn how you can do the same.

2. Issues with Land Boundaries and Ownership Disputes

Boundary disputes are prevalent in Kenya, especially in rural areas. Conflicts can occur if the land has not been accurately surveyed or if the boundaries have shifted over time. To prevent future disputes, it is essential to engage a land surveyor to confirm the land’s dimensions and boundaries.

5 Key Tips for Protecting Yourself When Buying Land in Kenya

Based on our experience, we recommend the following tips for land buyers in Kenya to help protect themselves during and after the transaction:

1. Exercise More Cautioun with Public Land- if you’re buying land from government institutions, make sure to follow the proper procedures, especially for public land or land with historical issues like illegal allocation or land grabbing.

2. Avoid Paying Large Deposits Before Signing the Agreement- do not make significant payments before executing the sale agreement. Always ensure that the agreement is in place first.

3. Understand the Costs- be aware of additional expenses, such as stamp duty, registration fees, and lawyer fees. Plan your budget accordingly.

4. Verify the Seller’s Ownership- confirm that the seller has the legal right to sell the property by checking the title deed, conducting land searches, and ensuring there are no existing disputes.

5. Hire a Qualified Property Lawyer- always work with a lawyer who specializes in property transactions. They can guide you through the legal process, protect your interests, and ensure compliance with the law. Based on our experience, hiring a property lawyer is more of an insurance than an expense.

You can also read our other equally informative blogs here including key factors to consider when buying land in Kenya to get the best possible property. If you have any questions regarding buying land in Kenya check out our Frequently Asked Questions. If you need legal help with land and property matters, send us a confidential message through our contact us form, or directly call us at 0795470796 for an affordable legal review.

Frequently Asked Questions About Buying Land in Kenya.

Based on our interactions with land buyers in Kenya, the following are some questions most of them have about buying land in Kenya.

The minimum fee that a property lawyer is required to charge their clients is established by the Advocates Remuneration Order. This order outlines the standard rates and guidelines for legal fees, ensuring that clients are aware of the baseline costs associated with hiring legal representation for property-related matters. We recommend that clients understand these regulations, as they can vary by jurisdiction and may influence the overall expenses related to legal services in property transactions.

Contrary to popular belief, it is not possible to determine the authenticity of a title deed just by looking at it. The most effective way to verify whether a title deed is genuine is to conduct a title deed search at the Land Registry. This search can be performed either manually or online. This method is highly recommended because the Land Registry is the official custodian of all land-related information.

If your search reveals no discrepancies in the title deed, you can confidently conclude that it is genuine. However, if you find any missing, altered, or inconsistent information, the title is likely forged. In such cases, we recommend contacting a qualified property lawyer immediately.

The entire process can extend over several weeks or even months, influenced by various factors such as thorough due diligence, intricate negotiations, and sometimes cumbersome bureaucratic procedures. Each of these elements can add layers of complexity and delay, making the timeline for completion unpredictable.

A Certificate of Possession shows payment for a plot but does not prove legal ownership; only a title deed does. You should contact the selling company to inquire about the issuance of her title deed and the delays involved. In Nairobi’s Eastlands area, land-buying companies often issue Certificates of Possession due to the subdivision of large parcels, a process that has faced controversy and legal challenges, resulting in hesitance from governments to issue title deeds for these plots.

Also, there might be a genuine delay in the issuance of title deeds because of the lengthy process that sub-division of land in Nairobi is, with many governmental bodies being involved. What is most important is for her to determine the projected period in which the seller anticipates procuring the title deeds, the timelines, and where the process has reached.

It’s essential to involve a property lawyer when purchasing land for due diligence on the property and seller, establishing transaction timelines, and securing safeguards. This includes ensuring that purchase funds are held in a joint escrow account or requiring a Professional Undertaking from the purchaser’s lawyer to withhold funds until the title deed is received.

To inherit property, you must go to court for either a Grant of Letters of Administration (if there’s no will) or a Grant of Letters of Probate (if there is a will). Once these are confirmed, the appointed administrators can visit the Land Registry to apply for registration as the property’s new owners, receiving a title deed in their name. If the property lacks a title deed, the administrators can also initiate the process to obtain one. After that, they can sell the property and transfer the title deed to the buyer.

We recommend you first consult the property lawyer who helped you buy the land. They will assist you in applying to the Registry to place a Purchaser’s Interest Caution on the land. Your lawyer will then guide you in suing the land seller and the new buyer under the Certificate of Urgency, asking the court to preserve the status quo through an injunction. You will seek specific performance, which means asking the court to require the land seller to complete the sale and transfer, as signed land sale agreements are legally binding. This applies if a land sale agreement is signed by both you and the seller.

Yes, foreigners can purchase land in Kenya, but they are restricted to leasehold titles, which typically last up to 99 years. Foreigners and privately owned companies whose shareholders are not all Kenyan citizens are not permitted to buy agricultural land unless the transaction has received an exemption. Additionally, land control boards are prohibited from granting consent for the transfer of agricultural land to individuals or companies that do not qualify to hold such land.

If you find yourself facing a dispute regarding land ownership, it’s crucial to seek the guidance of a knowledgeable property lawyer as soon as possible. An experienced attorney can navigate the complexities of the situation and assist you in resolving the issue through various legal avenues.

These may include mediation, where both parties work collaboratively with a neutral facilitator to reach a mutually agreeable solution; arbitration, where an impartial arbitrator makes a binding decision; or litigation, which involves taking the matter to court. Their expertise will be invaluable in ensuring your rights are protected and guiding you toward a favorable resolution.

When buying or selling property, there are important taxes to know. One key tax is stamp duty. This tax is based on the purchase price of the property. In urban areas, the stamp duty is usually 4%. In rural areas, the rate is lower at 2%.

Another tax to consider is capital gains tax. This tax applies when you sell land for more than you paid. You will pay 5% of the profit you make from the sale. It’s important to understand these taxes when involved in real estate transactions.

When a person passes away, their family must apply to the court for a Grant of Letters of Administration if there is no will, or a Grant of Letters of Probate if there is a valid will. Once granted, family members can go to the local Land Registry to register the property in their name. This allows them to obtain a title deed and transfer the property title if they decide to sell it.

When land is subdivided, the primary title is surrendered to the Land Registry, and new title deeds are issued for each subdivided plot. A reputable seller will ensure that each plot has its title deed, enabling a transfer to the buyer within 90 days, as outlined by the Law Society of Kenya’s Conditions of Sale.

If a subdivided plot has a number but lacks a title deed, or if sellers demand full payment before obtaining the title deeds, these are significant red flags. Purchasers should be cautious, as they lack the leverage to ensure the seller completes the title deed process and face challenges if another party claims ownership.

Additionally, certificates from some sellers or land-selling companies do not constitute legal proof of ownership. To navigate these issues safely, hiring an experienced property lawyer is strongly recommended.

The best approach is for the owner to subdivide the land before selling it to you. Avoid paying the full purchase price upfront without having the title deed processed. If the owner cannot afford to subdivide, consider signing a Sale Agreement and paying a 10% deposit to cover subdivision costs.

Before paying the deposit, conduct a thorough search, check with neighbors, and engage a trustworthy lawyer for guidance and drafting the Sale Agreement. Paying the full price before subdivision gives you less leverage, and you risk disputes over ownership without proper proof. An agreement signed in front of the area chief may not protect you.

Legally, a restriction serves as a warning to anyone considering dealing with a piece of land or property, indicating that there is an unresolved issue. Based on our experience, we recommend conducting a thorough land search at the Lands Registry so that the buyer fully understands the nature of any restrictions on the property. These restrictions could include cautions, inhibitions, prohibitions, charges, wayleaves, court orders, or injunctions.

From the land search, the buyer will also learn who imposed the restriction. This could be the government, a state parastatal (especially if it’s public land), a family member, another interested buyer, or even the Lands Registrar for that area. Answering these questions can help protect you from potential fraudulent land transactions that may lead to serious issues down the line.

Confirm the owner is the registered owner of the land by conducting a search using a copy of the title deed. Request the owner to provide:

(a) a copy of the title deed;

(b) a copy of their Passport (bio-data) page or national ID to verify the names match;

(c) a copy of the power of attorney, which must be in writing, signed, and registered at the land registry.

Additionally, have a lawyer verify the powers granted under the power of attorney to ensure the owner authorized the sale of the land.

We recommend asking the owner for either a copy of the title or the title number if a copy is not available. Having a copy of the title makes it easier to search for the land registry for the land in question. If the owner does not have a copy, they should at least know the title number.

Approach your property lawyer who will reach out to the land registry officials, explain your situation, and provide them with the title number so they can provide the much-needed information for due diligence.

If the owner cannot provide either a title copy or the title number, we strongly advise you to consider purchasing a different piece of land and walk away from this option.

Based on our experience, the best approach to investigating and purchasing land is to engage a reputable property lawyer or law firm. They can assist you in examining the land identified by your sister, which you have approved, and handle the purchase formalities.

An experienced property lawyer or law firm can ask the seller questions on your behalf regarding the land and its ownership. They will guide you through the entire process, ensuring you receive a valid title deed in your name. They are well-equipped to manage any issues that may arise during your journey to land ownership and are dedicated to preventing you from being taken advantage of.

We strongly advise against purchasing land that does not have a title deed. A land share certificate is not equivalent to a title deed and cannot prove ownership.

According to the law, a valid certificate of title or title deed issued in the names of the owner (whether buyer or seller) serves as sufficient legal proof that the person named on the title deed is the rightful owner of that land. Without a title deed, you cannot be certain that the land genuinely belongs to the seller, which poses a significant risk for you as a buyer. Additionally, it is impossible to prove your ownership of the land solely with a share certificate.

Although this practice is common among land sellers, land-buying groups, and self-help organizations, it can lead to legal complications. If someone else presents a title deed for the land you’ve purchased and accuses you of fraud or trespassing, the court is likely to favor them over you.

Legally, if the land you purchased was not jointly owned by the seller and their relatives, or held in trust for them, then those relatives have no claim to your ownership.

A relative cannot assert rights over land owned by someone else. If they dispute your ownership, you can sue for a permanent injunction to stop their interference.

Relatives or the community can only claim a right to the land if it is considered communal property, as is often the case in Maasai land and other pastoralist areas where land is held in trust for the community by individual members.

ypically, property acquired by a husband and wife during their marriage—such as land, vehicles, or houses—is considered marital property. This means that it cannot be sold or used as collateral by either spouse without the written consent of the other, even if the property is listed solely in one spouse’s name.

If there is no written agreement in place stating that your wife voluntarily relinquishes her rights to the property upon being reimbursed for her contribution, you cannot be certain that she cannot block the sale of the land. She may claim that the land is marital property, argue that she never consented to the sale, and point out that she has not been repaid for her contribution or share.

It may be beneficial for you that the title of the property is in your name. Having proof of payment—such as Mpesa messages, bank transfer receipts, or witnesses who can verify that you paid her—might support your case. We strongly recommend consulting a property lawyer to receive legal advice tailored to your specific situation.

A contract binds the parties involved and is enforceable in court unless it can be proven that one party was a minor, signed under undue influence or duress, experienced misrepresentation or mistake, entered into an illegal contract, or if the contract was frustrated.

In that case, the sale agreement signed by both the seller and buyer is binding. The seller cannot sell the land to another person, as it has already been sold to you, nor can they refund your money unless you have breached the agreement by not paying the full amount or not paying on time.

If you have paid the agreed amount on time, the seller cannot resell the land, assuming it has a registered number and a title deed. There’s much that goes into such a case such as cautions, the power of the Registrar over cautions, the power of the court in braches of contracts, and much more, which is why we strongly recommend you contact a property lawyer to understand which part of the law protects you based on your situation.

Before buying any land in Kenya, it’s essential to conduct due diligence to verify the seller’s identity and the Title Deed’s authenticity through an official search at the Land Registry. While you can do this yourself, hiring a reputable property lawyer can help identify potential red flags.

Visiting the land to assess its condition and speaking with residents and leaders can further verify ownership. Once the ownership is confirmed and you are satisfied with the land, request an agreement for sale. Review the terms carefully and ensure it is properly signed, keeping a copy for your records.

A property lawyer can assist with due diligence, conduct necessary searches, confirm the land’s status (ensuring it’s not government-owned), and negotiate favorable terms.

Based on our experience, it is very risky to proceed without a title deed, as title deeds are the only authentic and legally recognized documents of land ownership in Kenya. A mere certificate does not hold any legal weight according to our laws. Consequently, it would be extremely challenging for anyone to prove ownership of the land, particularly if another party presents a title deed for the same property.

When purchasing land from a SACCO, ensure it has a title deed instead of just a certificate, as the title deed confirms legal ownership. Before moving forward, conduct thorough due diligence to verify the property’s details.

We strongly recommend hiring a reputable property lawyer or law firm to assist with this process. They can perform the necessary checks, negotiate on your behalf, and ensure that the final transaction correctly transfers the title deed into your name, safeguarding your investment.

We strongly advise against purchasing leasehold land with an expiring lease, as the renewal process is often lengthy, costly, and filled with complications. The current owner should ideally manage the lease renewal before selling the land to you.

There are risks involved, as land cartels and fraudsters may target expiring leases, potentially causing disruptions such as missing files in the land registry. This can lead to delays and the need for you to provide documentation that you may not have. For these reasons, the current owner should resolve these issues before selling the land after the lease has been renewed or extended.

Legally, if the land has been sold and the buyer has paid the full agreed-upon amount, you cannot reclaim that land, as it is now legally owned by the buyer. You can only regain ownership in two situations: if the buyer fails to pay the full purchase price, thereby breaching the Sale Agreement, or if you make an offer to the buyer to repurchase the land, and they agree to sell it back to you.

However, if the buyer has been “extending the boundaries,” this could be considered encroachment. We recommend hiring a surveyor to assess both parcels of land and their boundaries—the land that was sold and the land that remains in your possession. This survey will help determine whether the buyer has encroached on your land and to what extent. Knowing the size of the land sold (in acres or hectares) is essential for this process, and if there is a title deed for the sold land, it will indicate its size.

We also recommend that you engage a qualified property lawyer immediately. They can assist you in officially complaining about the encroachment with the local Land Registrar. The Land Registrar will investigate the issue by summoning the buyer and any witnesses to the sale (such as community elders) and consulting the relevant records at the land registry regarding both the sold parcel and the encroached land. After the investigation, the Registrar will issue a ruling and provide a report on the matter. If the land has been sold and the buyer has paid the full agreed amount, you cannot reclaim it, as it is now legally owned by the buyer. You can only regain ownership if the buyer breaches the Sale Agreement by failing to pay the full price, or if they agree to sell it back to you.

If the buyer has encroached on your land, we recommend hiring a surveyor to assess the boundaries of both parcels. This will help determine the extent of the encroachment, especially if you know the size of the sold land from the title deed.

Additionally, it’s advisable to engage a qualified property lawyer to file an official complaint about the encroachment with the local Land Registrar. The Registrar can investigate the issue, summon the buyer and any witnesses, and consult land records. Afterward, they will issue a ruling and a report on the matter. This is a general overview; you may need more specific legal advice tailored to your situation.

We strongly recommend engaging a qualified property lawyer, as this situation likely involves serious forgery. The case appears to be a fraudulent sale facilitated by forged documents. Land cannot be sold without the owner clearing all outstanding rates and obtaining a Land Rates Clearance Certificate, which should accompany the signed Land Transfer Forms submitted to the Land Registrar.

If rates have not been paid, a valid Clearance Certificate may not have been presented, or a fake one could have been used. Important steps include placing a caution, applying for a green card, obtaining a police abstract, and possibly involving the Fraud Unit of the DCI. A property lawyer can help you navigate this process safely.

Supporting Sources

WRITTEN BY:

Joshua Munuve is a Digital Marketing Associate at Musyimi Damaris & Company Advocates. He has driven the growth of the law firm's online presence from getting no clients online to getting multiple and consistent clients a month to the point of online inquiries and consequent clients being more than walk-in inquiries and consequent clients. This has been achieved through his web development skills.

REVIEWED, FACT-CHECKED & APPROVED BY:

Damaris Musyimi is the Founder and Head Advocate at Musyimi Damaris & Company Advocates. With over three years of experience in legal practice, she has assisted numerous Kenyans in recovering more than 100 hectares of land. Additionally, she has guided many individuals in purchasing property and has supported families with succession and inheritance matters. Several legal organizations she previously collaborated with continue to consult her on various legal issues.